From early adopter to Ideal Customer Profile

How B2B SaaS startups can identify their target customer: From $0 - $1 M ARR

Why it matters

Firstly, let me bust my least favorite myth: thinking about ICPs, target audiences, and segmentation is not a Marketing exercise.

‘Who is it for?'’ is the most important question to answer about your business. It has a drastic impact on everything you do, including Marketing, Sales, Product, Engineering, and HR. At the very least your leadership team should be able to answer this question in unison. Target audience segmentation isn’t ‘Marketing Mark, age 36’, it’s what every leader should eat for breakfast. Without leadership alignment your VP’s and Heads Of will start running in opposite directions, ultimately tearing your value proposition apart.

From a Product perspective: By zooming in on a specific target customer, and putting in the legwork to build a deep understanding of the job they’re trying to get done and the challenges they’re facing, you can build something remarkable. Something that does a specific thing better than any other solution. The alternative is building something that ‘kind of’ pleases everyone by doing 100 things… poorly. A nightmare to maintain (feature bloat!), market (no clear positioning), and ultimately: use.

Don’t forget:

Create internal alignment on your ICP and re-align regularly.

Be as specific & explicit as possible. I recommend writing down your assumptions or knowledge in Target Audience Descriptions.

Be honest about your riskiest assumptions. Please don’t niche down for the sake of niching down, if the niche you pick isn’t based on any real-world learnings (I’ll dive into this in the 0-state section).

Adjust as you learn.

Defining Target Audience, ICP & persona

For each of these terms, there are many definitions floating about. For the sake of clarity, these are the ones I use:

Target audience: A group of people + the job they’re trying to get done (possibly narrowed down further by adding their values)

ICP: ‘The firmographic, environmental and behavioral attributes’ of a company/account ‘that’s most likely to buy your products and services, become long-term users, and recommend you to others’. This definition makes it clear that your company’s ICP will likely change over time. Your ‘early adopter ICP’ won’t be the same as your ‘early mass-market ICP’, and you can have multiple ICPs in each bracket.

I recommend splitting into a new ICP if there are big differences in:

Jobs, pains, gains (compelling reason to buy)

Ease of reach/acquisition (e.g. slower decision-making cycles, different actors in the decision-making cycle)

Ease of retention/ expansion

LTV or CAC: Payback period

competitive space (ICP already has a satisfactory solution to their problem)

Persona: Personas are fictional characters you create based on research, and they represent segments of your market. In a B2B SaaS setting, personas are descriptions of the real people who make up the company you’re selling to. Persona descriptions should only focus on what’s relevant. Demographics rarely are.

Each ICP contains multiple personas with different jobs, pains, gains, motivators, and fears. For example end-user, decision-maker, buyer, implementor, and maintainer.

If you fail to understand the different personas in the decision-making cycle, which role they play and when, their stages of awareness, their motivators and blockers, you will lose.

Now let’s get to it: How to identify your company’s ICP.

Phase 1: 0-state. Early-stage startup without real-world data

As an early-stage startup with 0 or few customers, you’re in a pickle. You know you need to focus on a specific target customer, but you don’t have access to enough real-world data (in the form of sales and retention) to jump to any hard conclusions. You simply don't know yet who your company’s ICP should be. Discovery & validation is the name of the game.

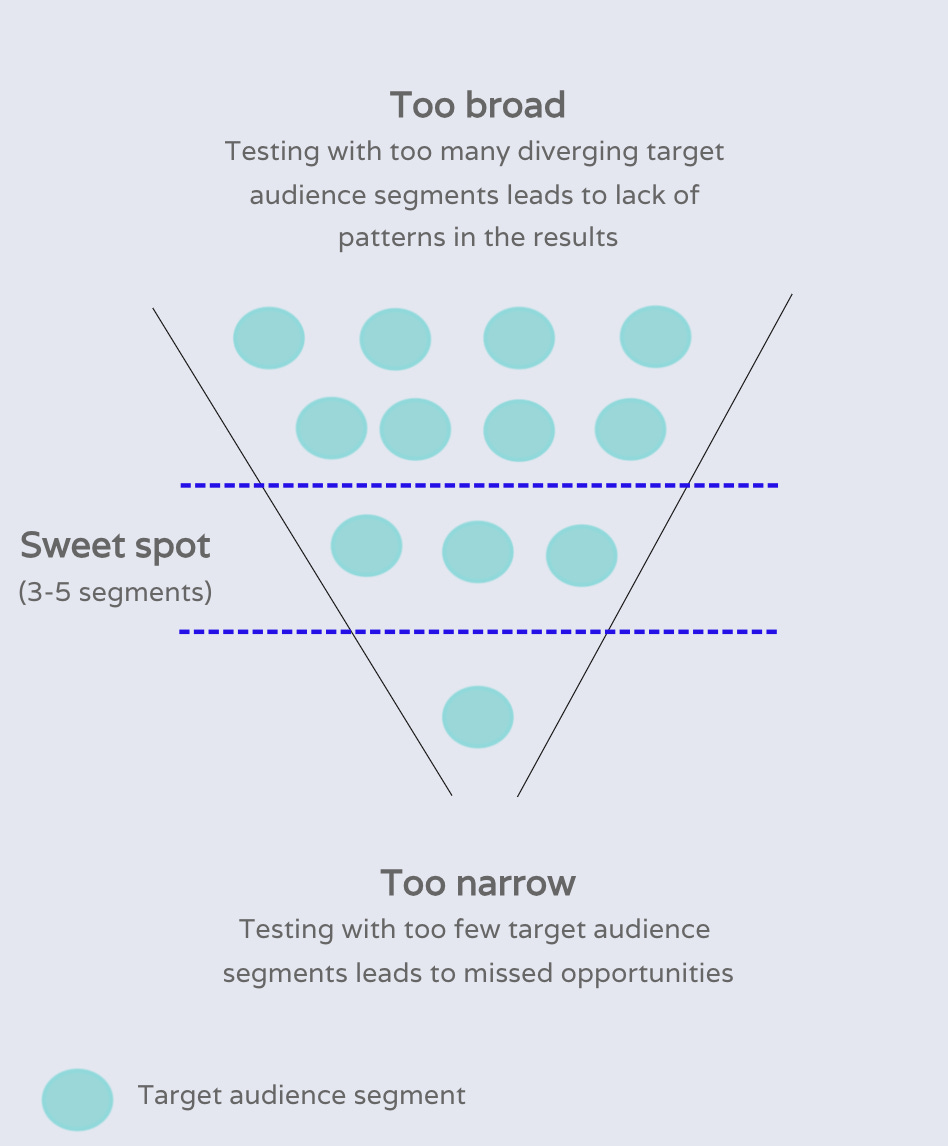

However: If you cast too wide a net in your discovery and validation process (e.g. customer interviews and surveys) by doing research and experimentation on ‘anyone’, the results will be so heterogenous that you’ll fail to detect patterns. As a result, you won’t learn anything.

The key is to strike the balance between narrowing down too much (lack of real-world learnings) and not narrowing down enough (outcomes too heterogenous, no patterns).

But 0 isn’t really 0

Although nothing has been validated yet through a significant number of signups or sales, as a founder, you do have clear assumptions about potential target audience segments. You didn't get into this business without reason. You know the market, you've done your preliminary research, and you’ve been speaking to important actors.

The way forward: Leadership alignment sprint (top 2-5 potential ICPs)

I work with early-stage startup leadership teams to compile a long list of potential ICPs, and then cut that list down through a structured 1-week process, ending with the top 2-5 potential ICPs to focus your research efforts on. The aim is not to land on the #1 ICP to double down on. Without real-world learning, it’s simply too early for that.

After removing the potential ICPs that are clearly not viable, the person with the most customer knowledge prepares Target Audience Descriptions for each remaining ICP, focusing on the job to be done, and the situation they’re stuck in. At this stage, that’s usually a member of the founding team.

Each ICP is ranked on the following factors during a leadership workshop:

Compelling reason to buy (Jobs, pains, gains)

Ease of reach/acquisition (e.g. slower decision-making cycles, different actors in the decision-making cycle)

Ease of retention/ expansion

LTV or CAC: Payback period

competitive space (ICP already has a satisfactory solution to their problem)

#1 ‘compelling reason to buy’ is weighted the most heavily. We are looking for the strongest pain, which is unresolved and recurring.

Phase 2. ≈100 paying, recurring customers

Congrats, you’ve proven some traction! Many companies at this stage, especially those with a horizontal product, find that their customer base is filled with early adopters from a variety of ICPs or target audience segments. It’s cool to have customers, but serving such a wide variety of target audience segments is leading to diluted messaging, a bloated product or having to maintain several product versions, and a lack of internal alignment.

You’ll start to feel the need to focus your resources on a #1 ICP. And at this point, you have your first real-world learnings to jump to directional conclusions.

Three tactics to getting to identifying #1 ICP

It’s time to build an understanding of your paying power users: The people who are engaging with your product the most and are willing to pay for the value you deliver. These are the people you want to tailor your product and messaging for.

I would recommend combining the findings of all four tactics listed below.

1. Enrich & dig into the data

Enrich your account data with publicly available company data to understand who is currently getting value out of your product (company size, industry, segment, etc.).

If you don’t have a CRM yet, Airtable is a great freemium spreadsheet tool that allows you to easily pull in data from multiple sources, and enrich the data manually where needed, for example with industry, segment, and company size data. You can use the grid views to filter for specific cohorts (such as your power users, or the users on the most expensive plans), and Interfaces to create dashboards.

2. Leadership alignment sprint ( #1 ICP)

Very similar to the sprint for 0-state startups (see above), with the big difference that the Target Audience Descriptions aren’t filled with assumptions, but real-world learnings. The Descriptions should be drafted by a customer-facing team member who knows the customers well, such as Customer Success or Key Account Management.

During a workshop with the entire leadership team, we rank each ICP on the following must-have factors:

Compelling reason to buy (jobs, pains, gains)

Ease of reach/acquisition (e.g. slower decision-making cycles, different actors in the decision-making cycle)

Ease of retention/ expansion

LTV or CAC: Payback period

competitive space (ICP already has a satisfactory solution to their problem)

#1 ‘compelling reason to buy’ is weighted the most heavily. We are looking for the strongest pain, which is unresolved and recurring.

If there’s a tie, you can move on to the nice-to-have factors:

Distribution (Do we have a channel in place to reach that audience)

Pricing (does our pricing match with the value gained by the customer)

Next target customer (are there adjacent target segments we can naturally expand to)

There can only be 1 winning ICP!

3. Customer interviews

Start talking to your paying power users to understand what makes them tick. You can find my template interview guide here.

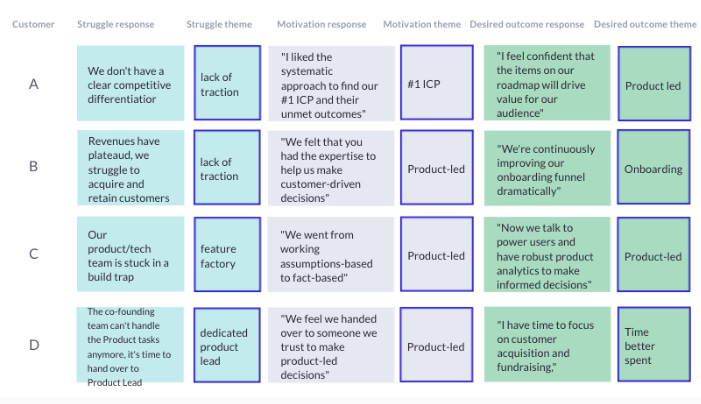

I’m hugely inspired by Georgiana Laudi and Claire Suellentrop’s ‘Forget the Funnel’, which contains tips & tricks to identify your customers’ struggles, motivations, and desired outcomes. The book recommends creating a table, where each row represents a customer and each column a question. Add a summary for the responses to each question in the right cells, but make sure not to paraphrase too much: You want to keep your customers’ original language to achieve language/market fit.

After summarizing the answers, categorize each response into a theme. This allows you to easily detect patterns.

Make sure to speak to at least 15 paying power users, so that you can detect reliable patterns. Of course, this doesn’t even get you close to statistical significance, so only use the outcome to get a directional read, and validate your findings with experiments.

Strive to keep up a cadence of speaking to 3 power users every week.

4. Product/market fit (PMF) survey

The PMF survey is directed at your existing customers who have recently used your product. It revolves around the key question: “How disappointed would you be if you could no longer use this product?”, options being: Very disappointed, somewhat disappointed, or not disappointed”.

According to Sean Ellis (co-author of the book ‘Hacking Growth’, who ran early growth in the early days of Dropbox, LogMeIn, and Eventbrite), a 40% “very disappointed” rate is a strong indicator of having achieved product/market fit. This is a high benchmark, which most startups don’t achieve. However, you can use the raw data to segment your answers and identify which customer cohort would be most disappointed to see you go. This gives you a clear indicator of who your Ideal Customer is. According to Ellis, your test results can already be reliable with as few as 40 respondents.

Superhuman’s CEO Rahul Vohra wrote a great breakdown of how they used the PMF survey to identify their ICP.

Getting started with the PMF survey

Define “customer who has recently experienced the product”. What does ‘recent’ mean for you? To understand recurrence and recency benchmarks, compare yourself to your analog version (For example: if you’re delivering groceries via an app, compare yourself to how often customers usually visit the supermarket)

Create the survey. Besides the ‘disappointment’ question you can ask additional questions, but make sure only to ask the most important things: You should aim for a maximum of five questions. Write the questions in plain, human language. Good extra questions can be

“Who would you recommend this product to?” ( → Identify your target audience)

“How can we improve this product for you?” ( → Identify new features)

“What’s the main benefit you’re getting from our product” ( → Identify your core-value. P.S. Your core-value is not what you think it is, but what your customers think it is.)

Gather the results in a Google Sheet or in Airtable. You’ll need access to the raw survey responses, not only the aggregated results compiled by the tool you use, or you won’t be able to segment your respondents.

Important notes:

Allow respondents to answer anonymously so that they can be honest

Only include customers who recently experienced your product’s value

Run this test at the right time. The aim is to test whether you have achieved product/market fit and to learn who your ideal customer is through segmenting. If your business is already very mature, asking the question “How disappointed would you be if the product no longer existed” could be shocking to loyal customers.

Disclaimer: This can be a lot.

Does your team need guidance or an extra set of hands to get going? Value Rebels can help! Reach out at else@valuerebels.com or book a call with me here.

Great guidance, Else!