How to tie product changes to business impact

Merging Hierarchy of Metrics with Opportunity Solution Trees

Show me a PM without business acumen, and I’ll show you a big clunky product that’s collecting dust on a shelf.

It’s pretty easy to build features. With the right setup, it’s also not hard to ship them fast. The difficulty lies in shipping the right features that customers want and driving a business impact. Failing to do this has severe consequences:

Waste of resources (R&D is expensive)

A bloated product (heavy to run and maintain)

A bloated product (difficult to explain and sell)

As a senior PM or product lead, it’s your responsibility to trim the fat. However identifying the opportunities worth pursuing takes practice and a deep business understanding.

In this article, I outline the structured approach I’ve used with various clients, from small and bootstrapped to big corporations, to help their senior product staff and leadership teams identify opportunities that drive business results.

A little heads up: this one’s all about focus, focus, focus.

Skip ahead:

Identifying and aligning business and product outcomes

Level 1, 2, and 3 business impact metrics

Customer opportunities

Potential solutions

Ex-post analysis

The full picture: From company goal to solution idea

Before diving into each step on a granular level, let’s look at the picture as a whole.

You’ll work from top to bottom, starting with the overarching business goals you are trying to achieve. These should come from the leadership team. Individual teams usually lack the high-level, complete business view to be able to set the right goals, and a top-down definition of company and product goals is necessary to align everyone. Of course, this doesn’t mean that the leadership team shouldn’t work hard to get the rest of the team on board. If the company offers multiple products, the second level can be about breaking down the business goal between those products.

For the next step, we move to the team level. The team works together to break down the business goals into further business and product metrics.

For each metric, the team asks itself: which 3–5 main product metrics have the biggest impact on this metric? These main product metrics should be mutually exclusive and collectively exhaustive (MECE).

This first part of the tree (from company goal to level 3) is inspired by the Hierarchy of Metrics (check out this article by Michael Karpov, CPO at Skyeng). Level 3 should always contain a product metric, which is where the merge with Teresa Torres’ opportunity solution tree happens.

Before we dive in on a granular level, I often fall back on Teresa Torres’ distinction between business outcomes/metrics and product outcomes/metrics:

Business metrics represent the overarching goal of an organization (examples: increase revenue, reduce churn, market leadership, reduce cost, or increase 90-day retention). They’re often lagging indicators, only allowing teams to react, but not to be proactive.

Product metrics on the other hand measure the value a product brings for the customer/business (examples: increasing engagement, increasing conversion, average order value, upsell increase, free-to-paid ration increase). Product metrics are often leading indicators for business metrics, and they’re more useful as a frame for product decision-making.

(Teresa Torres talks about this extensively in her book ‘Continuous Discovery Habits’ and on her blog ProductTalk)

1. Identifying and aligning business and product outcomes

Company goal

So let’s get granular and start at the top of the tree: your overarching company goal. As mentioned, internal alignment and a deep business understanding are essential here. Therefore leadership team should define it.

In my experience, this goal often is ‘revenue’ or ‘market share’. Don’t worry about this sounding generic, it’s usually the most honest answer. You’ll get more precise when you work your way down the tree.

I recommend setting a boundary or check metric to ensure that you’re not over-indexing on that #1 business goal. It’s relatively easy to increase revenue by lying to your customers about what your product can do, but this probably isn’t a great idea in the long run (never mind ethics).

An example boundary could be “with an average NPS above 50.”

Business goals per revenue stream

Your #1 company goal will likely be driven by various revenue streams, for example by the different products, modules, or services.

This is the time for your leadership team to review and decide:

Backward-looking review — Which revenue stream had which importance importance level for the #1 company goal over the past period of time? Concrete example: our task management tool has driven 70 percent of revenue, whereas our payrolling module drove only 10 percent in the past quarter.

Forward-looking decision — Which revenue stream is set to have which importance level for the #1 company goal over the next period? Concrete example: we want our new collaborative workspace to generate 50 percent of revenue in the next quarter (from 5 percent today).

If you have multiple products driving revenue, this creates necessary internal alignment and ensures you’re prioritizing the right ideas and using resources wisely. In some cases, it can also make sense to assign specific teams to the different product outcomes.

The tree isn’t set in stone. You should always be reviewing, learning, and adapting.

2. Level 1, 2, and 3 metrics

If you divide the business goals per product/revenue stream over separate teams, each team can establish its product metrics from the bottom up - but always in alignment with the leadership team. Letting teams define their own goals and metrics leads to more buy-in and commitment — a general feeling that what we’re working on makes sense.

If the company goals have been well-defined and explained by the leadership team, a strong team with enough context and business understanding should be able to identify which 3–5 metrics have the biggest impact on their key product metric.

You can draw this part of the tree from a gut feeling or internal knowledge, by logically brainstorming which 3–5 metrics are most heavily driving each metric one level above.

The next step will be to identify and support the importance level of each metric with proof points. For example: is our paying customer growth rate far below industry benchmarks? Or do we have more issues with retaining customers?

For each of these level 1 & 2 (business) metrics, you’ll analyze which business impact a (reasonable) fix in this metric would likely have on your company’s #1 goal (to keep things simple, let’s stick with revenue).

Many businesses overlook that customer retention or net revenue retention are far stronger levers than increasing customer acquisition. This Harvard Business Review article outlines how increasing customer retention rates by 5 percent has the potential to increase profits by 25–29 percent, and this Paddle article talks about the importance of retention and monetization (vs. new customer acquisition).

Now that you’ve identified which business impact metrics are the most important, you can go down in your tree following the right branch — the branch that will have the biggest impact on your company goal. By backing up your tree with a business case and supporting evidence, you create a map for yourself

As mentioned, you want level 3 to contain only product outcomes/metrics, so that the team can find viable answers to the question “what is blocking our users from getting us to this result?”. See the difference below:

Business metric: ‘What is blocking our users from generating us more revenue?‘. This can’t generate useful answers, since the question is too vague and selfish (focus on value capture by the business)

Product metric: ‘What is blocking our users from upgrading from free to paid?‘. This can generate far more concrete answers. Perhaps it’s because they don’t get to value fast enough, or their team members failed to accept their invite (focus on delivering value to the customer)

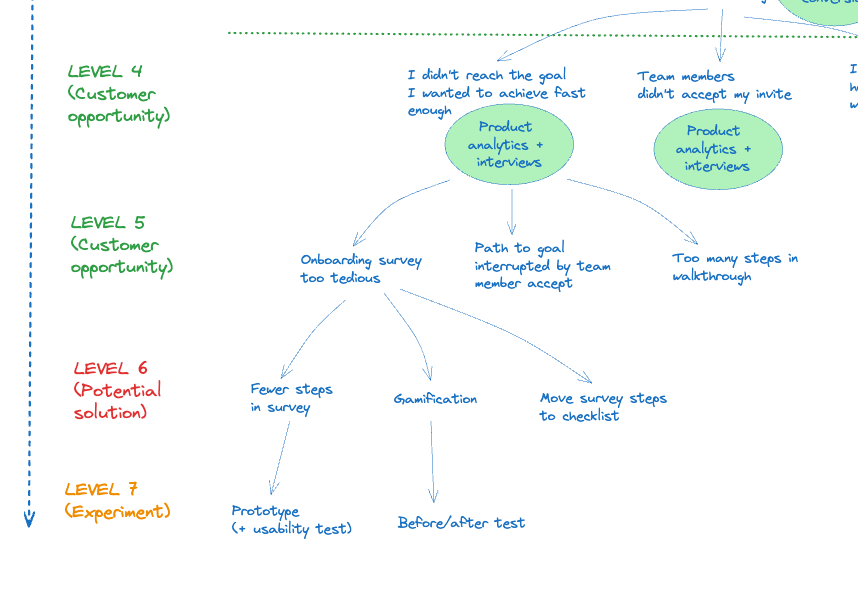

3. Customer opportunities

Assuming that your business goals are largely aligned with your customers’ interests, now it’s time to link your business metrics to customer opportunities.

Ideally, you can do this based on insights from conversations with customers. If you don’t have these yet, you can map out your opportunities based on gut feeling or knowledge of your product. In my experience, this is OK, as long as you flesh things out with proof points later on.

For example, let’s dig into the business metric “sign up-to-aha” conversion rate. The underlying issue you are tackling is the fact that new users aren’t reaching their aha moment, they don’t achieve what they set out to do within your product within a short enough time frame (time to value). Now ask yourself: why are users failing to get here?

Examples might be:

They need their team members to accept their invites to get to value, which isn’t happening

They don’t understand at all how to use a primary feature of the tool (e.g., create a workspace)

They can’t achieve their goal at all (the product doesn’t solve their specific struggle)

From each opportunity, drill deeper down by asking why over and over. Why aren’t users able to get to their goal fast enough? Because the onboarding survey is too long; because the path to their goal is interrupted; because they don’t know what to do with step x? And why is that?

In the second step, you’ll back up each of these customer opportunities with proof points, such as insights extracted from customer interviews, surveys, shadowing, product analytics data, etc.:

4. Potential solutions

Now that you’ve used both gut feeling and real proof points to identify the most important customer opportunities that link neatly to product, and up the ladder, to business outcomes, you can finally dip your toes into the solution space.

Always make sure to think of your ideas as potential solutions. Nothing is set in stone, and it’s important to draft each solution idea in a lightweight way. Don’t get lost in the rabbit hole of drawing up the first solution you imagine to perfection — describing each potential solution in 1–3 sentences is enough:

A fast, simple way to make a first cut in your solution ideas is with an impact/risk matrix. What’s great about this matrix is that you can avoid complicated scoring models, and simply compare one potential solution against another. I would recommend co-creating this matrix with your teammates. This team can be the product team, the cross-functional project or growth team, or the leadership team — whichever shoe fits.

This process can be quite rudimentary or gut-feeling-based, it’s just to make a first rough cut. Rule of thumb: inviting outsiders into your process (especially from different disciplines) will likely improve your results:

Example risk/impact matrix. You want to focus on the idea in the top left (red) quadrant (relatively low risk with high impact) first.

Minimum viable test

Now that you’ve identified your most promising (relatively low-risk/high-impact) solution ideas, it’s time to think about how you can validate your underlying hypotheses in the most lightweight way. You’re looking for a minimum viable test. The trick here is to hit both the minimum and viable marks.

Overshooting on the minimum means spending a disproportionate amount of resources, time, and effort to validate or falsify the solution idea. This is wasteful and doesn’t make business sense. An example would be spending six months to build, launch, and market a fully-fledged product with all bells and whistles to see if anyone will buy it.

Undershooting on the minimum means failing to attain the quality level to be able to assign the test result to your idea or assumption. An example would be creating a prototype that is of too low quality so that you can’t tell for sure whether any usability issues are due to your idea not working or the prototype simply being unusable.

Keeping this in mind, you’ll add your experimentation methods below your potential solutions in the Opportunity Solution Tree:

5. Ex-post analysis

You’ve gone through the entire tree from company goals, product goals, business impact, customer opportunities, and solution ideas. You’ve run experiments, identified the winning solution, and rolled out a v1.0.

Most businesses forget to take the final, important step: checking whether the change lived up to its promise through ex-post analysis.

It’s one thing to estimate whether a feature will be successful and drive your business goals upfront through lightweight experimentation. It’s another to check whether it moved the needle in the real world.

Of course, it depends entirely on the feature/change and your business model for how long you should wait until you can get meaningful results. This could be after a few weeks or after several months. And if you fail to tell your users about the new feature (through a public launch, an in-app notification, or otherwise), don’t expect any impact on your business metrics:

In this step, you’ll be answering two key questions:

Are users enjoying the feature? Are they adopting it? Of the users who did adopt it, how many are coming back to it regularly? You’ll uncover this through product analytics, the cornerstone of every data-informed product team. LogRocket offers solid product analytics and session replays

Has the expected business impact been achieved? Since you’ve followed the path outlined in your tree structure, you’ll know exactly which success metrics you’re expecting your solution idea to move. In the example of our tree, we were trying to impact the sign up → aha conversion rate, assuming that this has a huge impact on customer retention, our #1 lever to grow revenue from our product

Always ask yourself “Why?” or “Why not?” Just knowing that a feature is or isn’t being adopted isn’t enough. The real learnings come from extracting the why.

This might be tricky since in the real world multiple factors could be impacting the business metric. But just because something is hard, this doesn’t mean you should disregard it altogether. You can do this by interviewing customers, performing usability tests, etc.

Conclusion

As said in the introduction, it’s far more difficult to ship features that have a business impact than to just ship whatever your stakeholders are asking for.

But believe me, it feels pretty good to look back at your company’s growth and say with confidence, “My decisions played a big part in that.”

Work with me? I work with SaaS startups and scale-ups as an advisor or as an interim product lead. Connect with me on LinkedIn if you’d like to chat.

This article was originally posted on Logrocket’s Product Management blog

At first I thought: "If only there was a framework to connect Objectives to measurable Key Results", but then you integrated Impact Mapping and Leading/Lagging Indicators into a single, comprehensive model. Nice!