Week 1: Hunting for My Underserved Niche ICP

Merging AI, gut-feel, and real signal to find a niche with a strong, recurring, unsolved pain

Prefer watching over reading? Check out the YouTube video here.

What did I do this week?

1. The parameters for my niche come from personal experience and conviction

Tech people naturally gravitate toward solving problems they know firsthand. I’ve got a strong hunch this leads to an oversupply of similar tools in spaces like sales, marketing, dev, and product management, while “unfamiliar” problems often go overlooked and underserved.

On one hand, I tell founders to stick to what they know. Ideally, build for a problem they’ve personally felt.

But that comes with real risks: we can easily project our pain points onto our ICP (a classic mistake), and we end up swimming in the same red ocean as everyone else.

I’ve seen innovative, well-designed SaaS tools in the product management space struggle to stand out, despite great execution.

And I’ve also seen painfully simple point solutions take off, just by targeting an ICP still stuck using Excel sheets or clunky on-prem software with 12-month contracts.

That’s the kind of niche I’m looking for: underserved, overlooked, and currently relying on outdated tools.

Even if it means I need to put in more time upfront to truly understand the space and the audience.

My goal is to sell a relatively simple SaaS product with a founder-led, top-down sales motion. That means I’m targeting personas higher up in the decision-making chain. They should be the ones who feel the pain deeply and regularly.

I asked ChatGPT (GPT-4o with web search) to help me identify niche ICPs that meet four criteria:

Decision-maker accessibility

The ICP persona should be a manager, executive, or decision-maker (not just an end-user).

This person should be relatively easy to reach and engage with in a sales cycle.

Recurring & significant pain point

The ICP must experience a pressing, high-frequency pain point (ideally daily or weekly).

The pain should be directly tied to revenue loss, operational inefficiency, compliance risks, or other high-priority concerns for decision-makers.

Ripe for Disruption:

The current competitive landscape should be outdated and easy to disrupt with a simple software solution.

Examples of disruption-ready solutions include:

Complex, manual spreadsheet workflows

Expensive, locked-in enterprise software with poor UX

Industry-standard tools that are outdated and cumbersome

(feel free to come up with other examples)

SaaS viability and pricing

The audience should be willing to pay at least €1000 per year or €150 per month for a SaaS solution.

The sales cycle should be under 3 months, making it feasible to sell without long enterprise negotiations.

(See my prompt and further context here, under header “Step 1. Find an underserved niche”)

2. Gen AI tools (specifically ChatGPT and Claude) aren’t built to come up with innovative ideas from scratch, but they are great sparring partners

Neither ChatGPT nor Claude can take on the job of visionary founder. But they’re great as a sparring partner to a smart, creative founder who is able to tell apart good from bad at a glance.

I fed the above parameters into the AI models, hoping for brilliant ICP recommendations that would inspire me. No such luck.

At first glance, the responses given by Claude (3.7 Sonnet) and ChatGPT (4o and 4.5, with web search on) looked impressive. Lots of text (an A for effort!), well-structured, and ChatGPT gave me a pleasant table overview on top.

But after I opened the original sources for each argument that the AI made, I quickly noticed that the evidence underpinning each suggestion was weak.

Research fatigue set in quickly. It was hard to distinguish generic blah from interesting insights. Nothing really clicked for me. I had provided several example ICPs in the prompt (scaffolding, warehousing, logistics), and most of the AI’s responses (unsurprisingly) stayed close to this.

The LLMs did a poor job at backing up their arguments with strong sources—simply because they don't know what a good source is.

It takes expertise and judgement to know what good looks like.

I prompted each model to add multiple hyperlinked, recent (2024 or 2025), relevant sources for each argument it makes.

It grabbed blog articles produced by tech companies solving a pain point, highlighting how important this pain point is. The bias is quite obvious.

I debated with ChatGPT for hours over the course of a week, during which I constantly asked it to poke holes in our argumentation.

Some of the niche ICPs we came up with (feel free to steal one):

Finance Directors at mid-sized companies, struggling with manual forecasting

Procurement/risk manager at a manufacturing/retail company, struggling with third-party risk & vendor management

EHS safety managers at industrial/construction companies, dealing with workplace safety compliance

Data protection officers dealing with GDPR & record keeping

ESG/Sustainability reporting leads, struggling with quarterly or annual ESG data collection (I’ve previously supported a company serving this niche, and I suspect that in the end it will be a game of implementing a variety of different reports)

Warehousing/logistics managers struggling with inventory management (I’ve previously supported a company serving this niche, which I don’t want to compete with. The simplest solution I can imagine is a barcode scanner app for the warehouse workers)

Inventory/operations managers in retail/e-commerce, struggling with inventory forecasting and stock control (similar problem to the warehouse/logistics management. The simplest solution I can imagine is a barcode scanner app for the warehouse workers)

Fleet/logistics managers at small companies (5–50 vehicles), that struggle to assign drivers to routes and optimize routes. (I wonder how far I can get without any IoT devices/telematics/GPS tracking—I want to keep my solution simple. But perhaps there is a desire for a super simple tool that will allow users to simply connect routes to drivers and nothing more. Which could be especially appealing because it doesn’t have any fancy telematics)

Field service operators in compliance-heavy trades at 5–50 FTE companies, that struggle to coordinate field technicians to customer sites (Interesting, the problem seems similar to the “matching drivers to routes” problem of the fleet managers)

The common denominators for most of these?

Low software penetration and a positive competitive landscape to enter.

- Most SMBs in these audiences are still working with spreadsheets.

- The most well-known software solution in the product category is a heavy-handed, powerful ‘suite’ solution which is too expensive/complex.

- There are some startups in the space offering simple point solutions, but there is no winner yet.

Adding the “Why now” question improved results slightly

I asked chatGPT to shift its focus to niche ICPs (Ideal Customer Profiles) that have developed a relatively new and urgent need — in other words, ask itself: 'Why now?'

? For example, many social, health, and arts orgs lost funding after Trump-era budget cuts and reduced USAID support. That created a sudden gap, and a timely opportunity for new solutions.

This resulted in five more niches, of which I moved one winner ‘to the next round’:

Export Managers in Beauty and Personal Care Companies (Need to adjust to tariff changes and optimizing export operations to maintain profitability.)

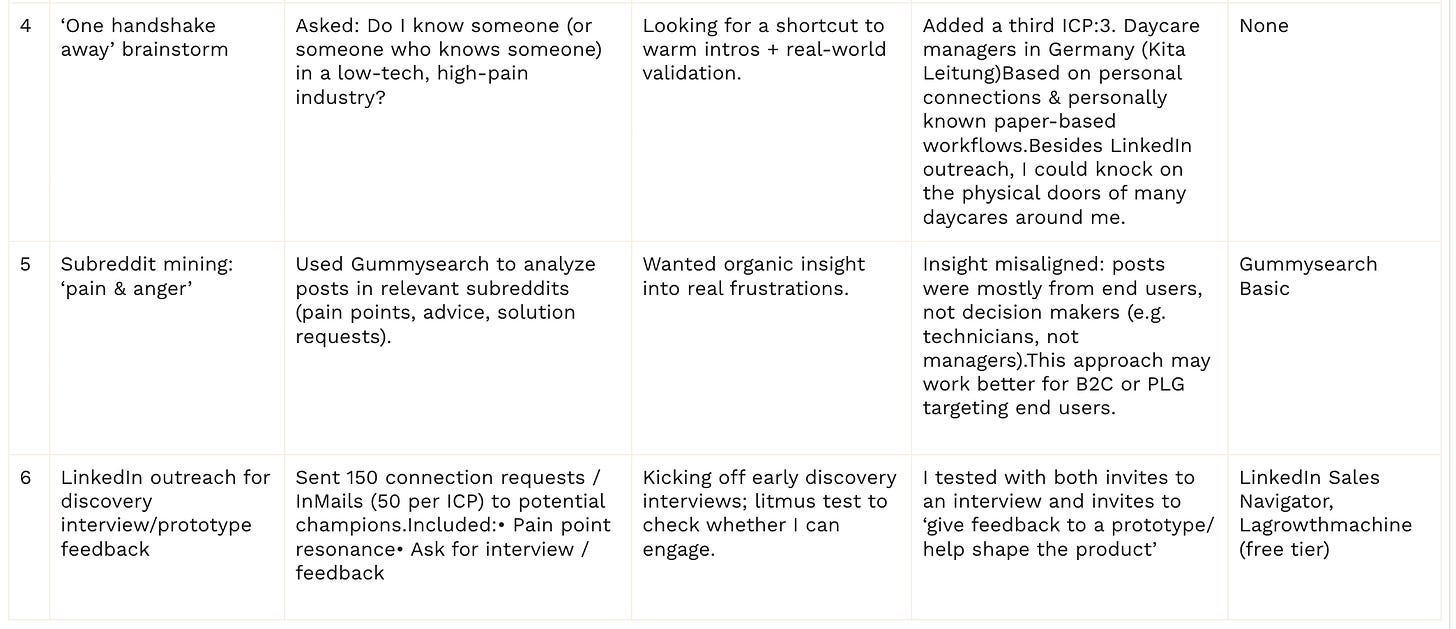

4. I picked ICPs for the next round (‘ICP smoke test’) based on gut feel

For each promising ICP, I ran a quick internal check:

Can I get up to speed on this problem space quickly?

What does the competitive landscape look like?

Does a simple, lightweight solution come to mind?

Do I actually want to build something for this audience?

The ICPs that made the cut:

Export Managers in Beauty & Personal Care (the “why now” ICP)

Field service managers at 5–50 FTE companies

Daycare leaders (Kita Leitung) in Germany

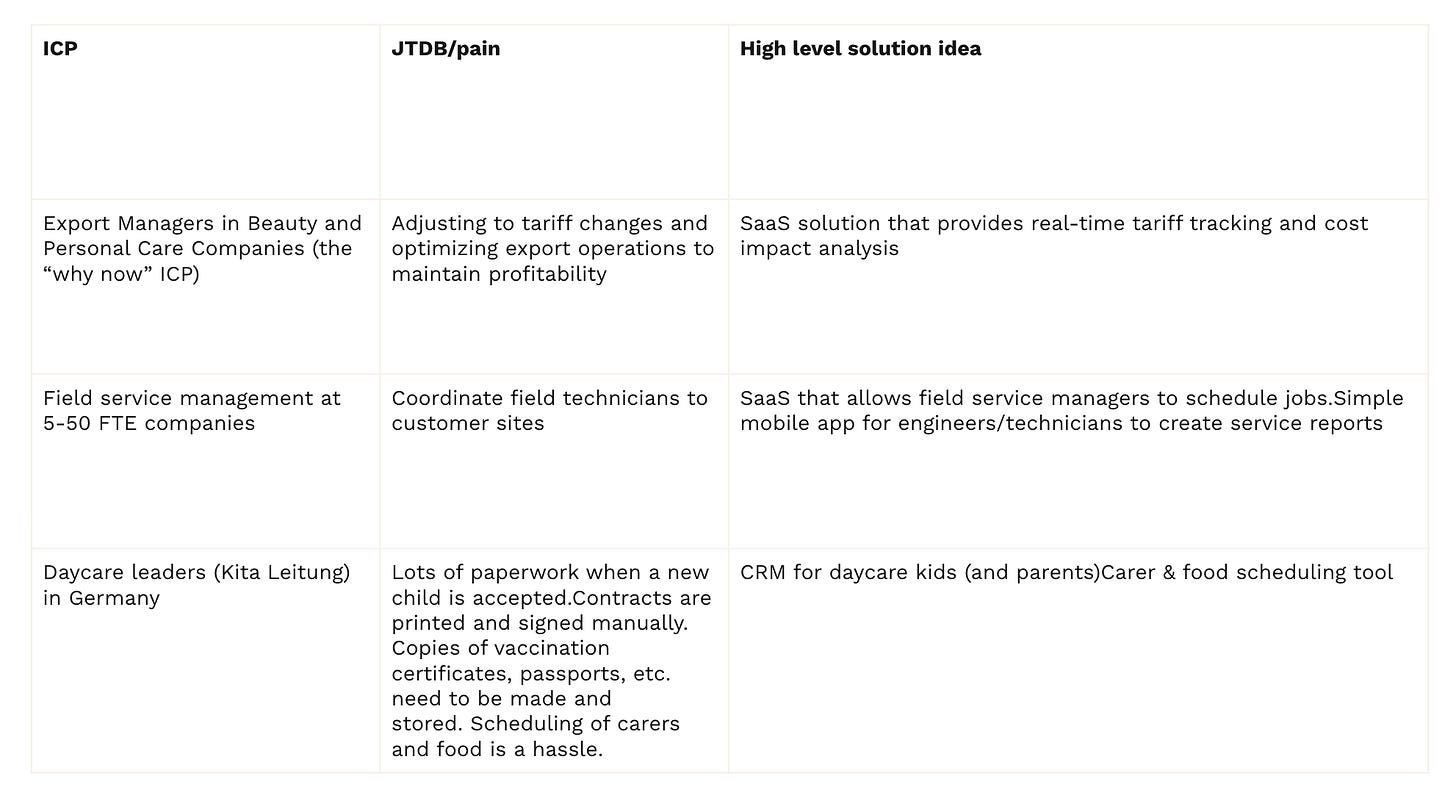

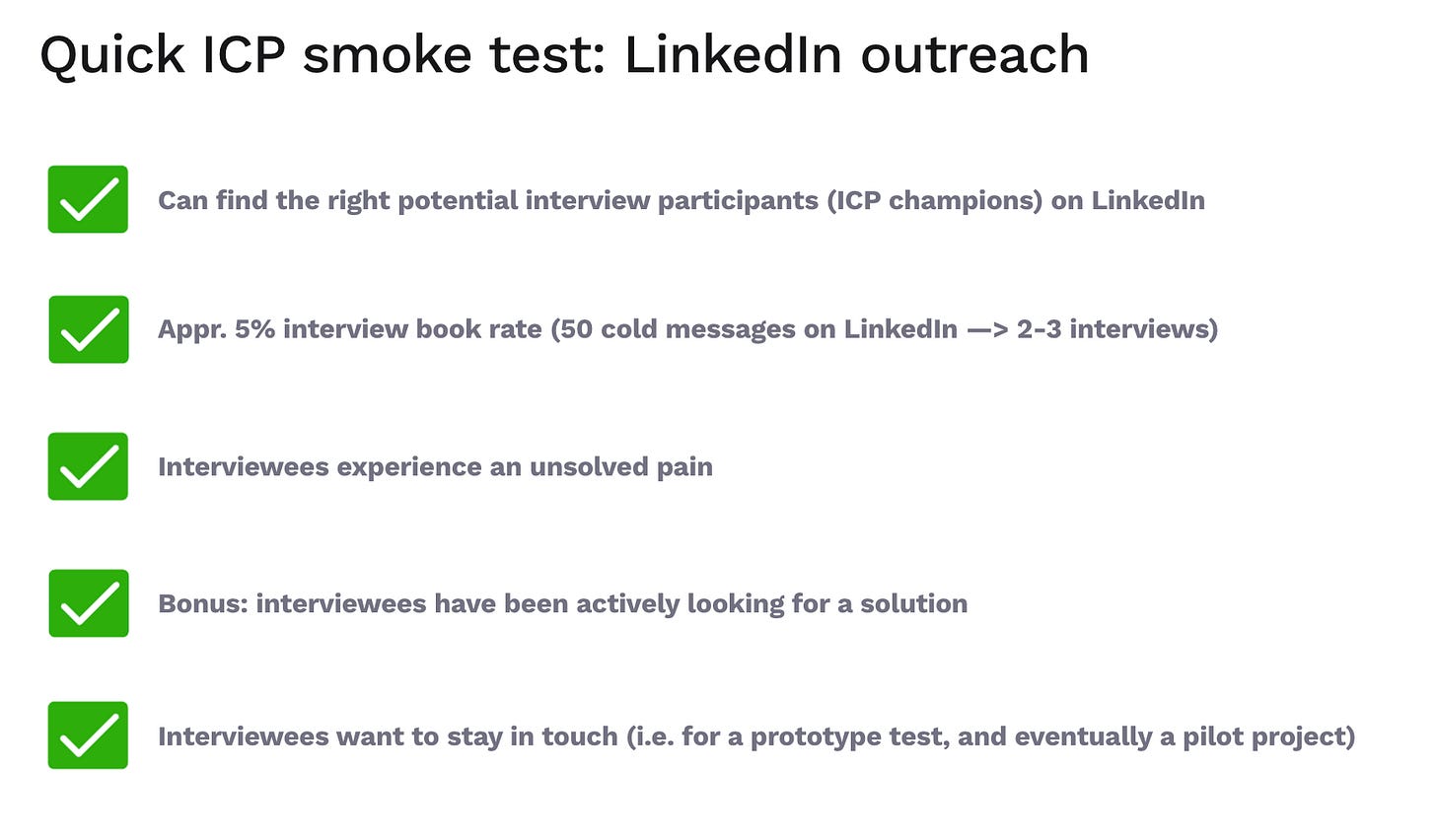

5. The next round ‘ICP smoke test’: LinkedIn outreach to collect real signal

“If you can’t get your ICP on the phone for a short discovery interview, what makes you think they’ll ever buy from you?”

This is what I tell early-stage founders who say discovery isn’t working because “no one wants to talk.” Time to take my own advice.

To test engagement, I reached out to ~50 potential champions per ICP via LinkedIn (Sales Navigator). My goal: get a quick read on three things:

Are they responsive?

Do they feel the pain?

Are they actively looking for a solution?

Roughly half were invited to a short discovery call, the other half asked to give feedback on a prototype. In past PM roles, I’ve seen higher response rates for prototype testing—some folks just prefer playing with a tool over talking about one.

If someone bites on a prototype, I’m confident I can spin up something “good enough” quickly using Replit.

Result: Two interviews completed with champions in the Field Service Management (2–50 FTE) niche within the first week.

What’s coming up next week?Exploratory interviews → Pulling out key insights and mapping opportunities in an Opportunity Solution Tree.

Prototype tests → Rapid “vibe coding” to test not just usability, but also desirability. I can now build prototypes fast enough to let users compare multiple solutions across different pain points. That means I’m not just validating features—I’m surfacing which underlying opportunity matters most.