How to connect business metrics to customer opportunities

A concrete example of connecting customer opportunities to the lagging indicator "Improve 30-day retention"

I spend a lot of my time helping product teams move from reactive, stakeholder-driven ways of working to strategic, outcome-driven ways. In this process, I’ve looked for a simple way to visually connect those outcomes to the decisions we make. There are plenty of frameworks that can help you do this, such as the North Star metric, impact mapping, opportunity solution trees (OSTs), etc. They all try to achieve similar things.

The truth is, it’s not really about the framework. I lean on Michael Karpov’s hierarchy of metrics (for the business metric part) and Teresa Torres’ OSTs (for the product goals and customer opportunities parts) because they both offer a great way to visualize why we believe our choices will have the desired impact. It’s important not to get hung up on the framework, but to zoom out to the larger context.

I’m often asked for practical examples of what this visual process of connecting business goals to customer opportunities can look like. In this article, I’ll outline such a concrete example for a “multi-aha” product.

Contents

Using a business goal as a framework for product decision-making

What’s a multi-aha product?

Most companies I work with identify multiple aha moments for their users — the moment they first realize the value of the product. There are two instances of use cases your product can solve for customers and provide value:

Multi use-case products — Your software solves a variety of use cases. It may include a customer knowledge base feature, live chat, AI chatbot, customer support helpdesk, etc., all under the same roof. Some users might come because they’re looking for a sales pipeline tool while others might come for the chatbot. If you don’t show them what they came for within a reasonable time frame, you’ll likely lose them forever

Sequential aha’s — Your product solves one primary use case but the user realizes the value in multiple steps. Some examples of this might be:

“These website templates look great” (aha 1)

“Wow, it was so easy to write good copy with the help of AI” (aha 2)

“I can deploy it with one button and I don’t have to buy a website URL separately” (aha 3)

Example of a sequential aha product

The example dives into a sequential aha for a B2B SaaS product analytics tool, comparable to Amplitude, Mixpanel, or Logrocket.

𝗧𝗵𝗲 𝘃𝗮𝗹𝘂𝗲 𝗽𝗿𝗼𝗽𝗼𝘀𝗶𝘁𝗶𝗼𝗻

Out of the box funnel reports

Feature adoption/retention reports

Natural language database queries

The go-to market strategy is product-led growth; users can enjoy a 30-day free trial.

𝗡𝗲𝘄 𝘂𝘀𝗲𝗿 𝗲𝘅𝗽𝗲𝗿𝗶𝗲𝗻𝗰𝗲

New organizations must install a code snippet on the website to track events. After this, a short onboarding survey asks new users which of the above core actions they want to perform first.

Using the business goal as a framework for product decision-making

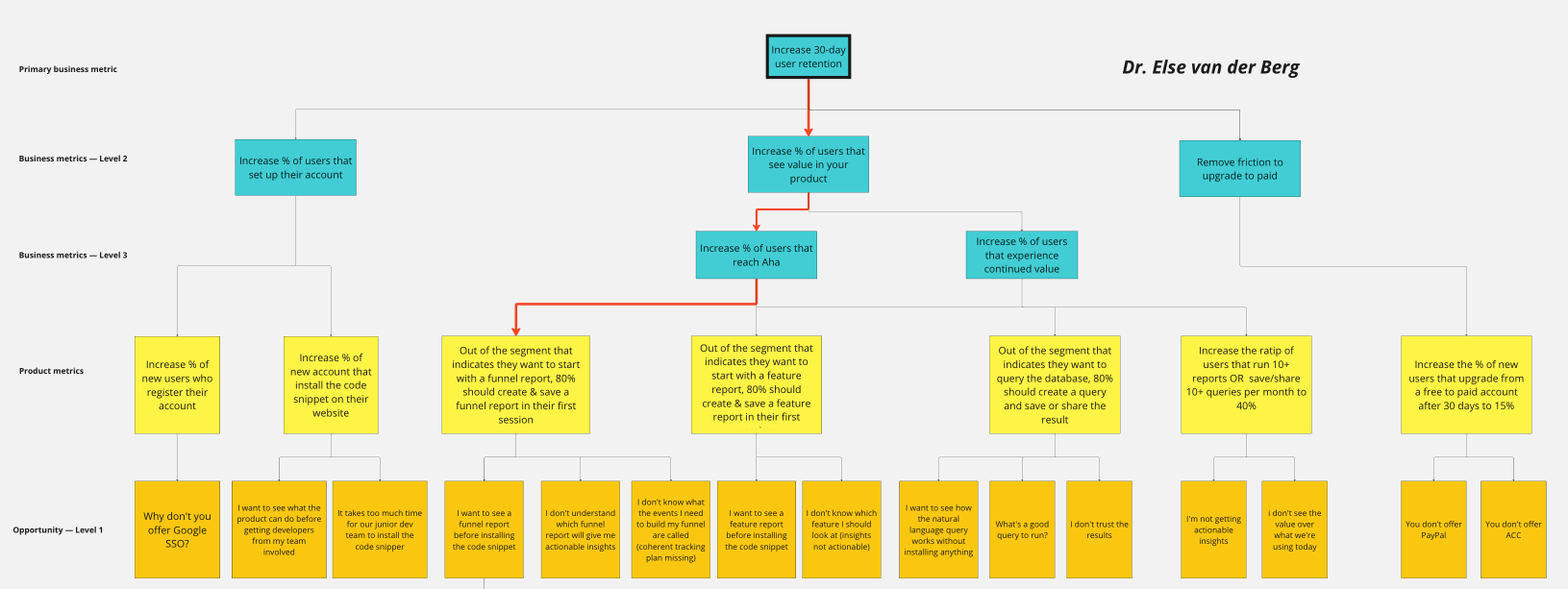

Now, let’s use a specific example of a business goal as a framework for making product decisions. Our business goal will be to increase 30-day user retention.

1. Breaking down the primary business metric

The overarching business goal to increase 30-day user retention can be broken down into three distinct “gates:”

Increasing the number of users who get through the account/organization setup phase (gate 1 in the customer journey)

Increasing the number of users who see the value of your product (gate 2 in the customer journey). This one can be further broken down into “see value for the first time” and “get continued value”

Upgrading to paid (gate 3 in the customer journey). One of the silliest, most often overlooked growth levers is removing friction to upgrading to a paid account. Some users might have gotten continued value out of your product during their free trial, but they’re simply not able to upgrade to paid because the company doesn’t have a credit card 🤯

We now need to determine which of these gates is the most important to tackle first. This is where a combination of quantitative and qualitative data comes in handy:

Quantitative

Funnel reports can help you see exactly where your users are dropping off in the flow. You can compare the metrics you find to industry benchmarks to check if you’re “healthy.”

Example funnel report:

What becomes immediately apparent from looking at our chart is that only 30 percent of people take the step of installing the code snippet. This is a significant hurdle that has a significant impact on downstream metrics.

According to popular SaaS benchmarks, a good activation rate lies between 20–40 percent. An aha moment is usually seen as the first component of activation, followed by continued value (sometimes referred to as eureka and/or habit).

Our 15 percent sign-up to an aha conversion rate falls short. This poor rate results in a 6 percent free-to-paid conversion rate, far below the SaaS benchmark.

As a quick intermission, I could go on a rant against metrics benchmarks. Within the terms “SaaS” and “PLG” exist a wide range of industries, target customers or ICPs, red or blue oceans, problems to solve, etc. Just because two companies are both subscription- and cloud-based or allow users to try before they buy doesn’t mean they’re the same in any other way. As a result, they should not always adhere to the same benchmarks, but it is helpful to have a statistic to compare to. I use benchmarks when I’m joining a new company and when the idea of measuring things is pretty new.

Qualitative

Next, say we shadow 10 non-customers as they sign up for our product for the first time. We watch them stumble through the steps and ask them to narrate their thoughts. Here we find a bunch of friction points at various steps of the user journey:

Account creation:

Why don’t you offer SSO? I don’t want to type my email address and a password!

Code snippet:

Oh, I guess I’m stuck here? I wish I could already see your analytics capabilities before having to get the rest of my team involved

This documentation on how to install the code snippet looks really long and complicated

Can you provide me with an estimate of how long it will take an average developer to install this snippet?

Creating a report:

I don’t know which type of funnel report to choose

I don’t know what the events I need to build my funnel are called (coherent tracking plan missing)

I don’t know which feature I should run a feature report for

Running a natural language query:

What’s a good query to run?

I don’t trust the results. How can I make sure that the AI got the SQL query right and the results are accurate?

We also look at session replays of new users to see which paths they take.

Based on this data, we decide that our primary focus will be increasing the percentage of users that reach an Aha. Our assumption is that by allowing users to try out the product without installing the code snippet, we can show them enough value to motivate them to install the snippet later in the customer journey:

2. Break the level 2 and 3 business goals into product goals

We follow the business metric branch “increase the percentage of users that reach aha.”

To split this metric into product goals, we need to understand which change in users’ behavior or sentiment shows that Aha is reached.

For a multi-aha product, we might need to do some customer discovery to understand what our Aha’s could be. In the case of our product analytics tool, there could be three primary Aha’s leading to three product goals:

* Just because a user has created a report or ran a query does not mean they were pleased with the result. A save or share action is a far stronger indicator. You could also ask for satisfaction with the specific feature with a one-question survey like, “Did you get useful insights from this report?”

We now decide which of these three potential Aha’s to focus on first.

You might think: why not just immediately move the code snippet requirement to later in the journey since this tackles all three Aha’s?

For one, we don’t want to run with the first idea that pops into our head. Instead, we want to prioritize opportunities and compare multiple ideas against each other. This process doesn’t need to take longer than a week. We can prioritize opportunities based on the evidence we have available today and run a quick ideation session to make sure that the best ideas bubble to the top.

Secondly, even if we decide to move the code snippet requirement, we still need to decide which aha we want to enable without code snippet installation first. By cutting our ideas as small as possible (instead of solving the problem for three aha’s at the time) we can adopt an agile development approach

Data-informed approach to selecting the right aha

We’ll combine the quantitative and qualitative data we have at our disposal

Quantitative — The funnel report feature shows the strongest adoption among new users (user analytics)

Qualitative — We ran a survey amongst 1,000 new users who signed up in the past 30 days and asked them for their primary goal for using our tool. We received 50 responses:

40 percent — Funnel report

30 percent — Feature report

25 percent — Natural language query

5 percent — Other (specified)

5 out of our 10 shadowed users indicated they wanted to run a natural language query first.

We decided to focus on the aha “I want to create a funnel report” first, with the corresponding product goal, “Out of the segment that indicates they want to start with a funnel report, 80 percent should create and save a funnel report in their first session.

3. Connecting the customer opportunities to the product goals

During our shadowing session, we already uncovered various customer needs, pain points, wishes, and desires (in Teresa Torres’ words: opportunities).

These are clustered underneath the moments in the user journey with their corresponding product goals:

4. Choosing our #1 opportunity to focus on

To reiterate, we’re only comparing the opportunities that are clustered under the product goal we landed on. This goal (out of the segment that indicates they want to start with a funnel report, 80 percent should create and save a funnel report in their first session) corresponds to our most important aha (creating a first funnel report).

Teresa Torres recommends factoring in four considerations when assessing opportunities:

Opportunity sizing. How many customers does it impact, how often?

Market factors. What does the competitive landscape look like? What opportunities and threats do we see?

Company factors. How well does each opportunity fit our mission, vision, and strategic objectives? How well is it aligned to our strengths and weaknesses?

Customer factors. How important is each opportunity to our customers? How satisfied are they with the alternative?

In our case, we can quite quickly jump to the opportunity “I want to see a funnel report before installing the code snippet.” We’ve seen the overwhelming importance of this opportunity reflected in both our funnel report (quantitative) and our shadowing sessions (qualitative):

Closing the loop

Below the selected opportunity will come multiple solution ideas, and under each solution idea come lightweight experiments, such as prototyping or A/B testing.

After testing and launching the idea that best addresses the opportunity “I want to see a funnel report before installing the code snippet,” product teams should make sure to measure over time:

Which ratio of users in the “I want to start with a funnel report” segment creates a funnel report in their first session? Do we reach our 80 percent goal? Why or why not? This is a leading indicator

Has this change had a positive impact on 30-day user retention? This is a lagging indicator

Overall?

Do we see higher 30-day user retention for the “I want to start with a funnel report” segment?

I hope this helps you in your day-to-day work!